Investment Clubs between Friends is a popular and wonderful way to explore opportunities together with trusted friends and family. Forming a trusted group can help keep things organized between different opportunities. It can also help share thoughts and concerns different people have about something before investing. Investment clubs exist for real estate groups, cryptocurrency groups, stocks, startup equity groups and more.

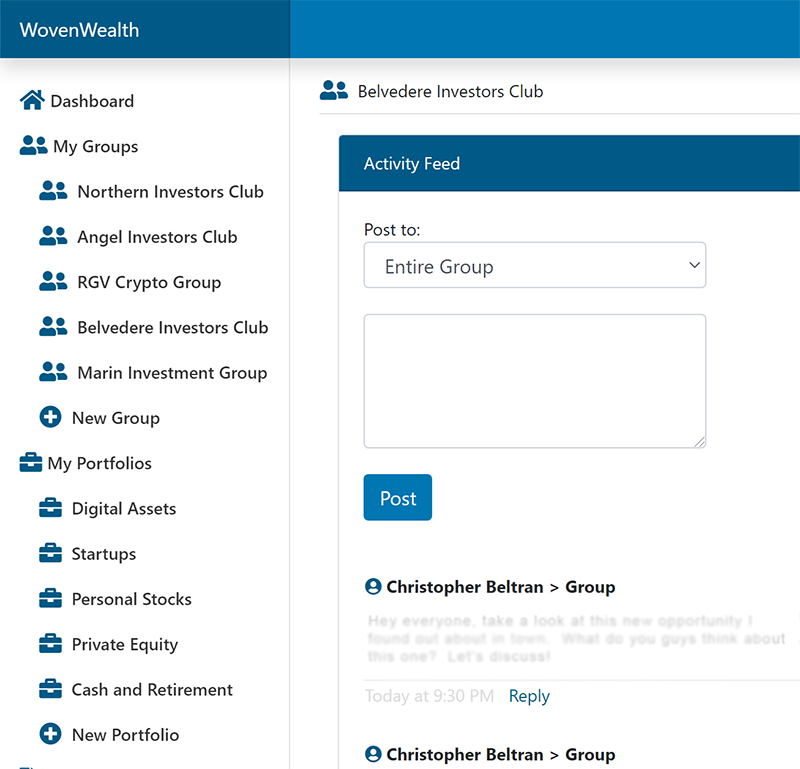

A Strong Collaboration Platform

Firstly, your group needs a home. Platforms like WovenWealth provide the ability to create private groups which can track lists of opportunities and allow you to discuss opportunities in an organized way. You can even reply and post via email to make discussing easier than ever.

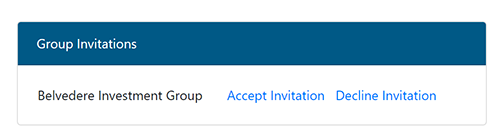

An Easy Way to Invite Friends

Whichever platform you choose should provide an easy way for you to invite them via email or other method.

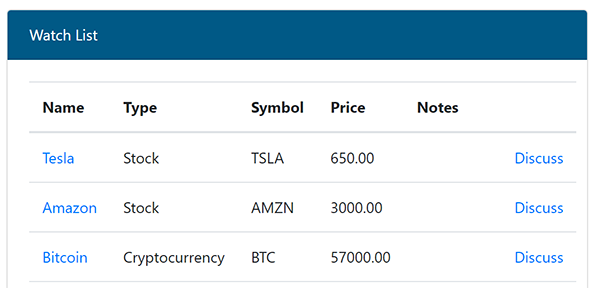

A Way to Separate Investments

Anyone can form a generic group on any platform, but many groups of friends are typically evaluating more than one investment at a time. Keeping those discussions separated and organized can be challenging with one big group. That is why WovenWealth Groups come with Smart Watchlists allowing you to add investments and discuss each one independent of the other. This helps keeps everyone sane and separated.

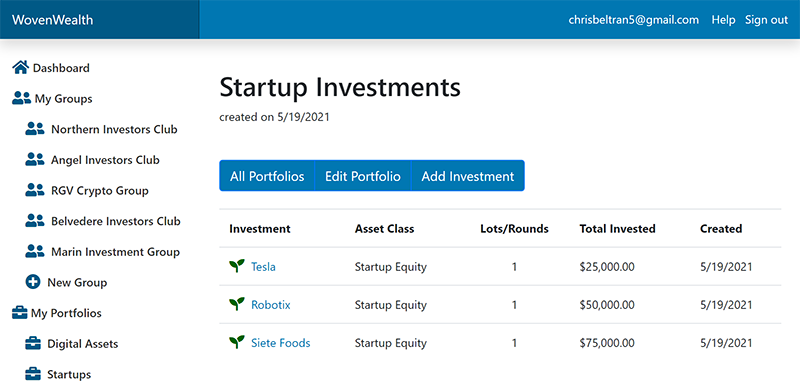

A Way to Track Investments Once Made

Once you make an investment, adding it to your portfolio helps a ton. Within WovenWealth, you can create as many portfolios as you want and add any investments to them including real estate, cryptocurrency like Bitcoin, startup equity, stocks and more. Track each lot/round separately and report on all your investments as a whole.

Tips for Investing Together

- Even with family and close friends, it’s always a good idea to formalize everyone’s investments so that everyone has paperwork and adequate protections on liability for their own contributions. It’s commonplace for groups to setup a Member-Managed LLC in which everyone contributes their own desired amounts and the LLC makes the investment. Profits from the investment go to the LLC which are then distributed among the investors according to their percentage of ownership. This gives everyone adequate liability protection and paperwork proving their investment. Forming a new LLC comes with its own risks and should always be evaluated with an attorney.

- Ensure that even though one person may be doing a lot of the research and due diligence, that in the end they are not managing your money. Giving your money to a loved one to invest on your behalf can carry with it risks and liabilities for them and yourself. It’s always best to invest yourself directly or through a business entity like an LLC.

- Keep in mind that advice from friends and family carries with it inherent bias as everyone can get excited over something quickly and not ask the tough questions or surface concerns that could point out risks in a potential opportunity.

Get Started Building an Investment Club or Group Today at WovenWealth